5 min read

Masterminding your strategy for ethical AI with a conscience

In an era where AI is reshaping the very fabric of our digital world, as a Digital Leader you’re not only a pioneer of technology advancement but a...

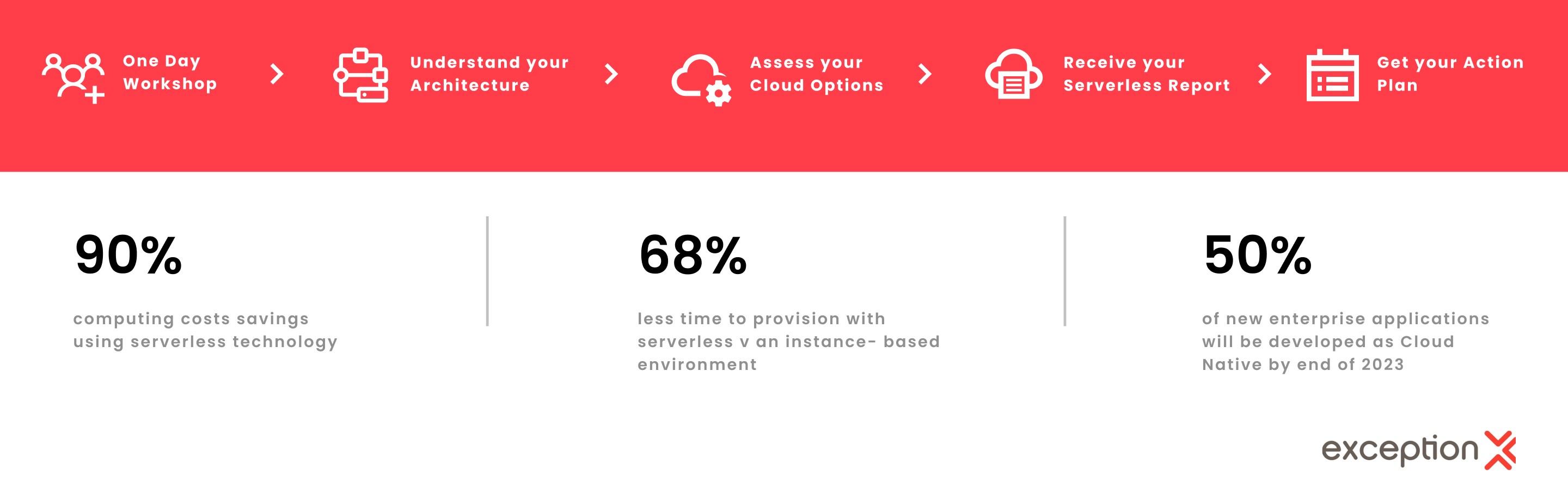

Automation in financial services is becoming more and more commonplace, a trend which is likely to continue in the coming years. According to a Gartner survey, 65% of financial services CIOs plan to increase spending on infrastructure technologies such as APIs, microservices and cloud this year and over 50% plan to invest in automation reducing the need for high-touch processes whilst reducing cost. Automation is an area, according to Gartner, that business leaders also view as a strategic imperative, reinforcing that it is likely to be a priority this year.

In this challenging and competitive landscape, driving real business value is absolutely critical. For financial services organisations to maximise the value of automation, or indeed, any other digital initiative, CIOs must work together with business leaders to, firstly, ensure that the organisations digital strategy is aligned with the wider business strategy, and, secondly, that it is explicitly clear how digital initiatives are contributing to the wider organisational goals.

Digital transformation can be expensive and disruptive, and as more tools and software get added to make up the technical deficit between newer banks and more traditional ones, the gap between them only widens. Automation can help bridge this gap, with technology such as Robotic Process Automation (RPA) capable of quickly and seamlessly interacting with software in the same way a human worker might, meaning that administrative tasks such as data entry and reporting between systems can be carried out by RPA tools rather than various supplementary applications or time-consuming human labour.

Not only can RPA help augment legacy solutions, it can ensure data is kept up to date, systems remain connected, and information is readily accessible at any time, bringing financial services organisations closer to a real-time response to customer needs. Many financial services organisations now view RPA as a stopgap to intelligent automation (IA) via machine learning (ML) and artificial intelligence (AI) tools, which can be trained to make judgments about future outputs.

There are many areas in financial services companies that can be increasingly automated such as loan fulfilment, wealth management, customer service, compliance, data management and fraud detection. Wherever there are repetitive, manual and administrative tasks to be completed, automation can streamline processes, reduce labour intensive administrative tasks and give workers more time for the human aspects of their job. RPA is being used to drive validation and approval of conditions around areas like business loans and insurance claims which not only accelerates the claim process but also reduces risk by using automation to capture up to date financial data from other systems. The Open Banking model is likely to lead to more growth in this kind of automation.

While automation presents a wealth of opportunities for operational efficiency and cost optimisation, it only delivers maximum value when properly integrated with business operations. Completely automating a process as complex, for example, as an insurance claim will depend not only on the RPA tools but also internal and external data services.

When technology is not properly embedded in business processes, the value it generates will always be restricted. The operating model must, of course, be driven from the top. Close collaboration of CIOs with business leaders to understand priorities will help ensure that the most beneficial application of automation technology is undertaken.

With the potential to streamline processes, increase efficiency and optimise costs, there is no doubt that automation in financial services is a trend that will continue to grow. If you are interested in learning more about how automation could be applied in your organisation, get in touch for a discussion with one of our automation experts.

Back to all insights

5 min read

In an era where AI is reshaping the very fabric of our digital world, as a Digital Leader you’re not only a pioneer of technology advancement but a...

4 min read

Generative AI is beyond a fun toy to illuminate your children's bedtime stories (try that if you haven’t!), but now a formidable asset for CIOs to...

4 min read

If ever there was a strong case to accelerate cloud and climate sustainability, look no further than the power of AI. It could offer significant...

Legacy Modernisation can be a complex and costly endeavour. By moving your data to the cloud and utilising data integration services to connect to...

Exception’s Carbon Reduction Plan (CRP) has been officially approved by the Crown Commercial Service, further strengthening our sustainability...

Exception is addressing industry demand for speed to application development and the drive to prioritise Digital Budgets, following the launch of its...